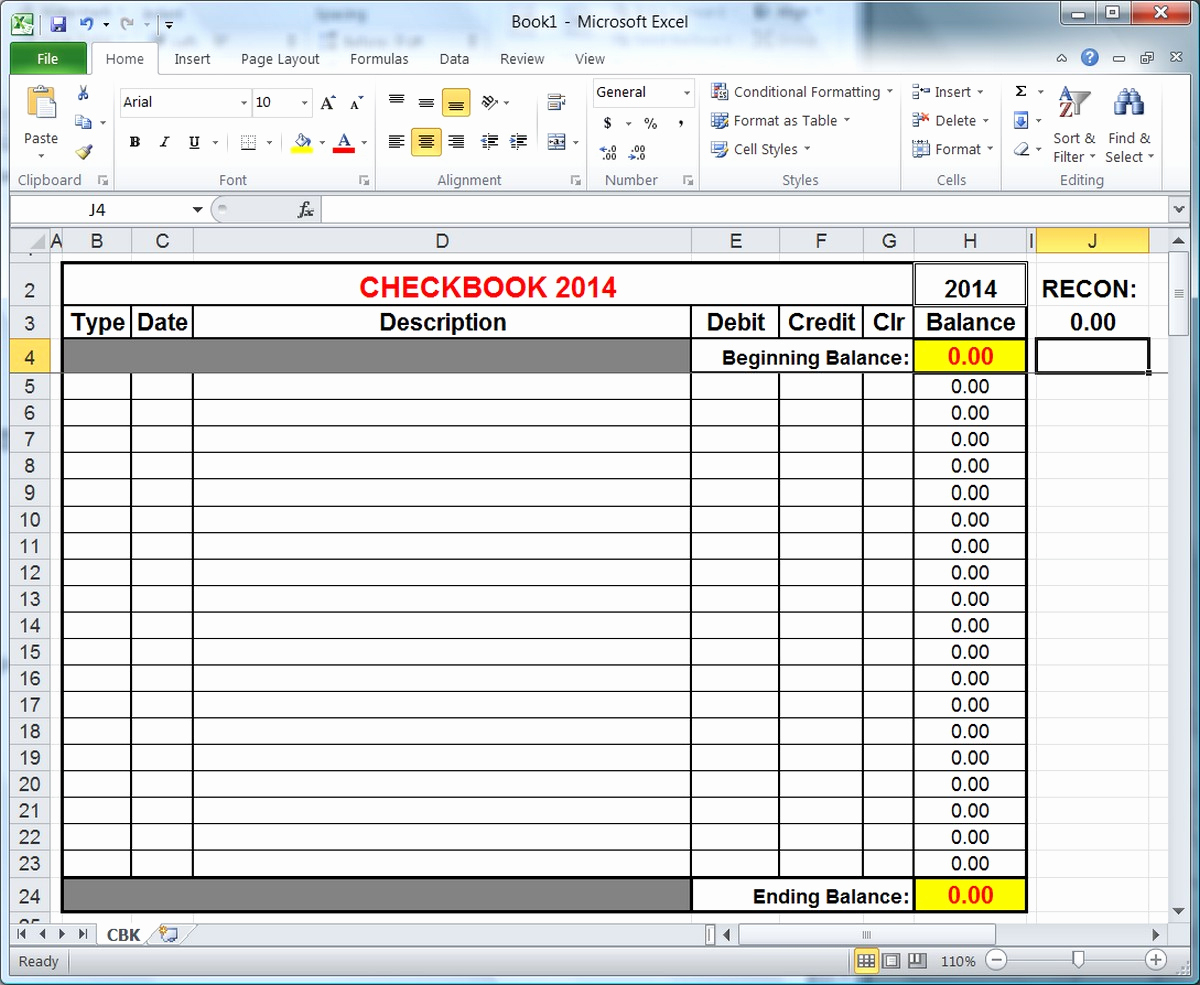

Smart budgeting can help you be ready for emergencies and changing expenses. “Use the information you get from this and look at your spending to find areas to cut back.” “If you regularly have nothing left over to save from paycheque to paycheque, then track where your money is going,” Mr. If you have a hard time saving, or if you often find yourself in debt, then a budget can help you get back on track. The latter might mean putting aside cash for a down payment on a house, saving up for big-ticket items like vacations or cars, or investing for your kids’ education or your retirement. We all have different financial goals, but for the most part, there are three places to put your money: paying for necessities, buying things (and experiences) that are optional, and saving for the future. What role does budgeting play in our personal finances? “Emotionally, it made me feel way less anxious about money because I knew I was in control.” But she could also see real progress: She started spending within her means, saving up for unusual expenses, and paying off debts. “It was terrifying to see the total amount owed,” Ms. She created a budget one year as a New Year’s resolution, and stuck to it religiously, checking her budget spreadsheet every payday and keeping track, on her phone, of money available for spending. But she was having difficulty paying off her student loans and was racking up credit card debt as well. Jenna Young in Halifax, for example, used to avoid looking at her bank balance and just hope she had the money to cover automatic bill payments. It forces you to pay attention, in other words, and avoid trouble. And if you have a hard time coming up with the money for big purchases, a budget can help you get there by encouraging you to put away a bit at a time. If you are trying to get out of debt, or pay off student loans or credit card balances, it’s far easier if you have a budget that includes those things and you stick to it. Here is a list of our partners who offer products that we have affiliate links for.Budgeting is an essential tool for meeting your financial obligations and goals. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Second, we also include links to advertisers’ offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market.

The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources.

You need a budget credit card payments for free#

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective.

0 kommentar(er)

0 kommentar(er)